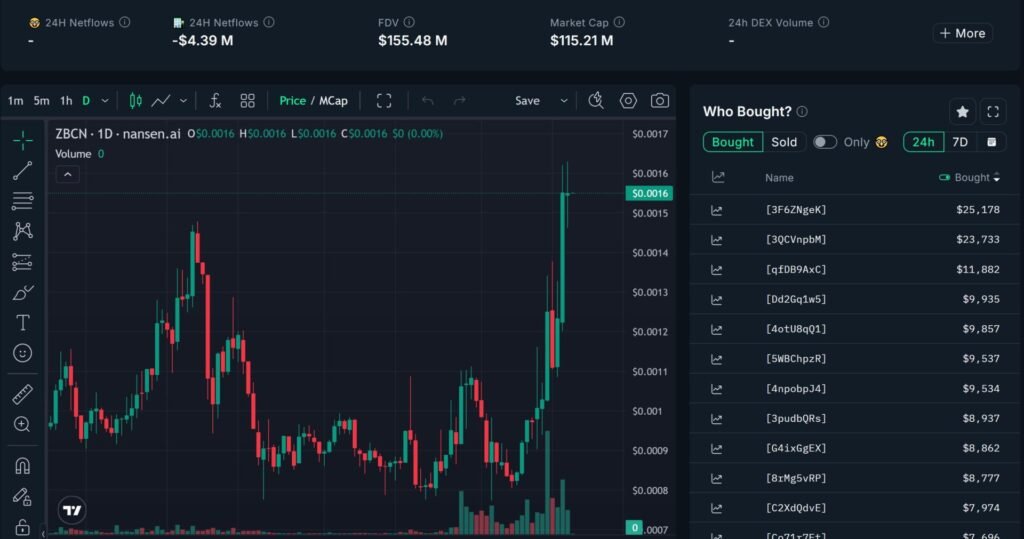

Zebec Network’s ZBCN token has witnessed an inflow of $2.35 million into fresh wallets in the past 24 hours, marking an 11x surge over the recent average.

This significant increase in demand has sparked discussions on whether this is an early sign of whale accumulation or a temporary market anomaly.

Coupled with a 29.1% price increase to $0.0016 and a market cap of $115.18 million, the token’s on-chain activity suggests growing interest among traders and institutional players.

Read Now: What Is the Best Time to Trade Crypto?

Surge in Fresh Wallet Inflows—A Bullish Signal?

A sudden spike in fresh wallet inflows typically indicates increased interest from new investors or large holders redistributing funds. In the case of ZBCN, the massive inflows suggest:

- Increased buying pressure, reducing immediate selling risk.

- Potential whale or institutional accumulation, as major buyers acquire tokens in bulk.

- Higher market participation, driving more liquidity into the ecosystem.

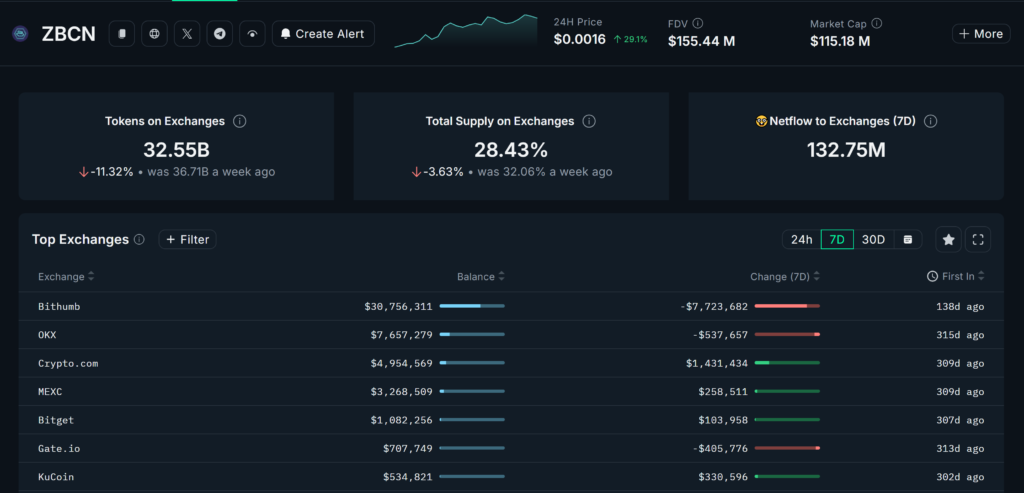

A closer look at on-chain data reveals that the total supply of ZBCN held on exchanges has decreased by 11.32%, dropping from 36.71 billion to 32.55 billion tokens within a week. This decline in exchange-held tokens typically suggests accumulation, as investors move assets into private wallets instead of leaving them on exchanges for quick trading.

Exchange Outflows and Whale Activity—Who’s Buying?

Exchange data shows that some major platforms, including Bithumb and OKX, have recorded outflows, while Crypto.com and KuCoin have seen notable inflows. Specifically:

- Crypto.com’s ZBCN balance increased by 1.27 billion tokens, signaling that buyers are accumulating in preparation for potential price moves.

- Bithumb and OKX saw significant outflows, suggesting users are withdrawing tokens, possibly for long-term holding or staking.

Whale tracking further supports the accumulation hypothesis. Large holders have steadily increased their balances, and a sharp increase was recorded recently, implying strategic positioning. The top-performing wallets on the PnL leaderboard are showing substantial unrealized profits, meaning holders are not selling despite the recent price surge, another bullish indicator.

Market Response and Price Momentum

The market has reacted positively, with ZBCN’s price increasing by nearly 30% in 24 hours, fueled by both buying pressure and reduced sell-side liquidity. However, an important factor to consider is whether this trend will sustain itself or fade as traders take profits.

Looking at the PnL leaderboard, we see that several top wallets are still holding significant amounts of ZBCN, with some realizing up to 67% ROI. This could indicate that early investors are still confident in further upside, while new entrants may be driving additional demand.

Another noteworthy development is that net flows to exchanges have increased to 132.75 million ZBCN in the past week, showing that some traders are moving funds back to exchanges, possibly for future selling. This mixed signal means the market is at a critical point, where further price movements will depend on whether accumulation continues or selling pressure increases.

What’s Next for ZBCN?

With strong buying activity, decreasing exchange supply, and rising whale accumulation, the short-term outlook for ZBCN remains bullish. However, key factors will determine its sustainability:

✅ Further fresh wallet inflows—If large inflows continue, it could confirm a long-term accumulation phase.

✅ Reduction in exchange reserves—A continued drop in tokens held on exchanges strengthens the bullish case.

✅ Whale movements—Monitoring whether large holders continue accumulating or start offloading will be crucial.

While current indicators point towards a bullish accumulation trend, traders should remain cautious. If buying momentum fades and traders start taking profits, the price could correct in the short term. However, if institutional investors and whales maintain their positions, ZBCN could see further gains in the coming weeks.

For now, on-chain data suggests that smart money is accumulating, making ZBCN a token to watch closely in the near term.

Read More: FistToken (FIST) Soars 80% as $242K DEX Outflows Signal Accumulation