The cryptocurrency market has once again shown its volatile nature, with ORA witnessing a significant shift in holder balances.

According to on-chain data by Nansen, the top 25 holders of ORA have collectively offloaded 145,236 tokens in the past 24 hours, a staggering 18 times the daily average sell-off.

This has raised concerns about a possible sell-off or shift in sentiment among large investors.

Massive Decline in Top Holder Balances

The data reveals that the top 25 holders’ balances dropped by approximately $94,564 worth of ORA tokens compared to the end of the previous trading day.

Such a significant decrease among major holders indicates that either large investors are exiting their positions or redistributing their holdings.

From the balance distribution chart, multiple addresses categorized as “High Balance” wallets show a decrease in their holdings. This suggests that whales are reducing their exposure, which could result in increased market uncertainty.

Read More: Kamala Harris (HARRIS) Token Gains 100% Amid Growing DEX Outflows

Price Impact and Market Sentiment

A closer look at ORA’s price action reveals a continuous downtrend, reinforcing the bearish outlook. The price chart shows a steady decline from previous highs, with the current price sitting at $0.6564. The lack of volume further supports the notion that demand is failing to counteract the ongoing sell pressure.

Such trends typically indicate that the market is struggling with liquidity absorption, which could lead to further declines if new buyers fail to step in.

On-Chain Transactions Highlight Large Movements

Examining the top transactions in the past 24 hours, a notable 204,000 ORA transaction was sent to a burn address. Additionally, several trades on Uniswap and 1inch DEX aggregators indicate that significant selling activity is occurring across decentralized exchanges.

The PnL (Profit and Loss) leaderboard suggests that some large holders are still sitting on substantial unrealized profits despite the recent decline, but others have started to cash out. This supports the narrative that whales could be strategically exiting before further price deterioration.

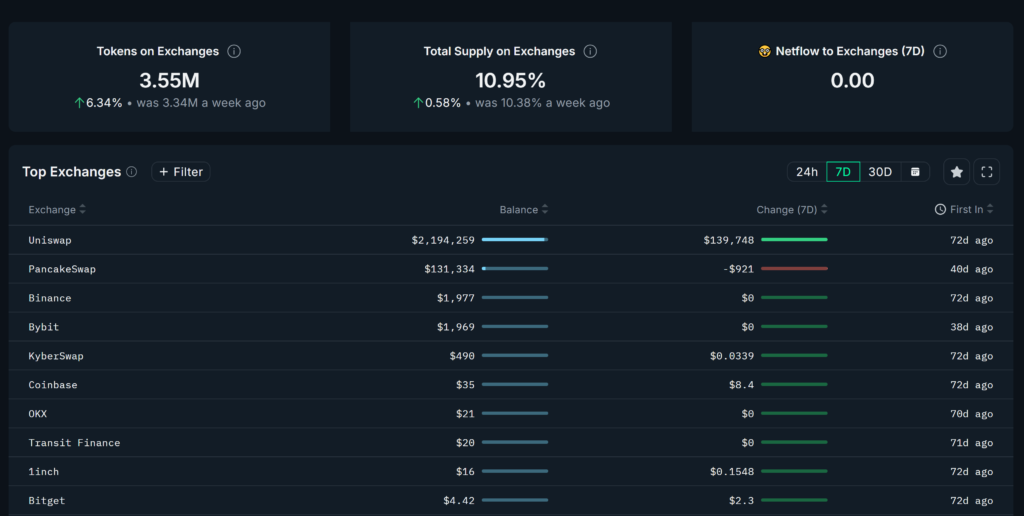

Exchange Data Shows Increasing Supply

The supply of ORA tokens on exchanges has increased by 6.34% in the past week, now standing at 3.55 million tokens. The total supply on exchanges has also risen to 10.95% of circulating tokens, which typically signals that investors are preparing to sell rather than hold.

While no major net inflows to exchanges were recorded in the past seven days, the growing supply on trading platforms implies an increased selling intent. If this trend continues, ORA could experience further downward pressure.

Is ORA at Risk of a Major Sell-Off?

With whale distributions accelerating, weak trading volumes, and increasing exchange balances, ORA may be at risk of further price declines. If large holders continue to liquidate, the market may struggle to find enough buying pressure to sustain current price levels.

However, it remains to be seen whether this trend will persist or if a potential reversal is on the horizon. If new buyers or institutional investors step in to absorb the selling pressure, ORA could stabilize and recover.

For now, traders should closely monitor whale movements, liquidity changes, and overall market sentiment before making significant trading decisions.

Read More: Fresh Wallets Receive Over $1M of HEHE as Token Gains 300% in Past Week

Conclusion

The recent data showing 145,236 ORA tokens dumped by the top 25 holders raises red flags for investors. With 18x the daily average selling pressure, increasing exchange supply, and a continuous price downtrend, ORA faces potential downside risks.

Whether this marks the beginning of an extended sell-off or a temporary shakeout remains uncertain, but cautious trading is advised in the current market conditions.