FistToken (FIST) has seen a significant surge of over 80% in the past 24 hours, fueled by a large wave of decentralized exchange (DEX) outflows.

According to the latest data, FIST experienced a $242,534 outflow from DEXs, marking a tenfold increase compared to its recent average.

This movement suggests strong accumulation activity as investors move tokens off exchanges, often a bullish signal for price action.

DEX Outflows Indicate Strong Buying Pressure

Blockchain data reveals that a significant portion of the FIST supply is being withdrawn from DEXs, reducing the number of tokens available for trading.

A decrease in exchange balances typically signals that investors are opting for long-term holding strategies, expecting further price appreciation.

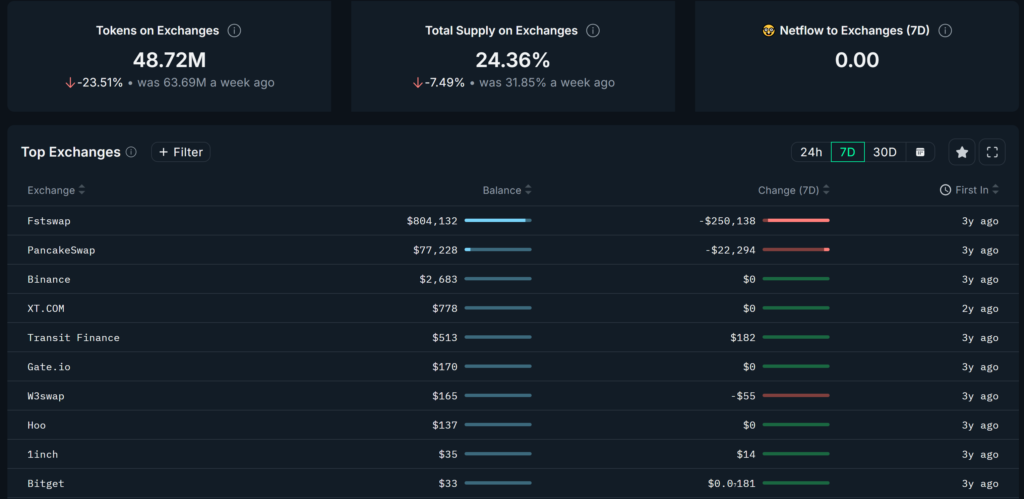

The token’s total supply on exchanges has dropped by 23.51%, from 63.69 million to 48.72 million FIST over the past week. This reduction in available supply aligns with the token’s recent price increase, reinforcing the narrative of accumulation.

Among the major DEXs, FstSwap saw the largest outflows, with 12.9 million FIST withdrawn in the last 24 hours. PancakeSwap also recorded notable outflows, with over 1.2 million FIST leaving the platform.

FIST Price Rally and Market Performance

As a result of the buying momentum, FIST’s price has surged to $0.0174, reflecting a 79.95% increase over the last 24 hours. This rally follows a period of consolidation in early February, with the token now breaking above key resistance levels.

FIST’s fully diluted valuation (FDV) has climbed to $3.46 million, with a 24-hour DEX trading volume of $6.85 million. Given the current market conditions, further price appreciation could be expected if buying pressure continues.

Read More: Top 25 ORA Holders Dump 145K Tokens in a Day (18x the Daily Average), Signaling Possible Sell-Off

On-Chain Holdings and Exchange Balances

Looking at entity balances, FstSwap remains the largest holder, controlling 22.11% of the supply, despite the recent outflows. PancakeSwap follows with 2.12% of the supply. Other notable holders include Binance, PinkSale Finance, and various smaller exchanges.

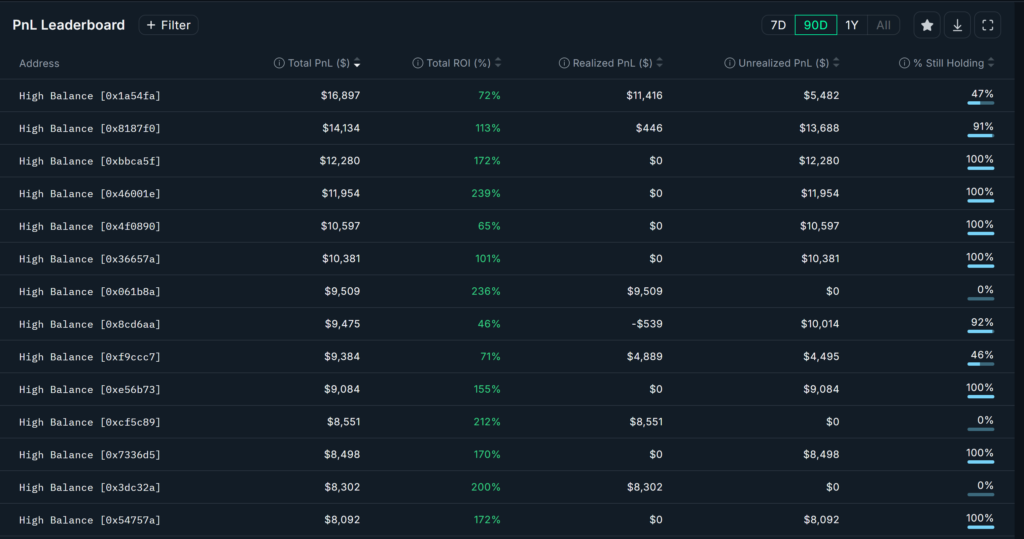

Additionally, the PnL Leaderboard data highlights substantial profits among top holders, with some addresses realizing over 200% ROI on their FIST investments.

Several high-balance wallets continue to hold their tokens, further reinforcing a bullish outlook.

Market Outlook and Future Projections

The rapid price increase and significant outflows indicate that investors are positioning FIST for further gains. If accumulation continues, FIST could extend its rally, targeting the $0.02 price range in the short term.

However, traders should remain cautious of potential volatility, as large price swings are common in low-cap tokens. Keeping an eye on exchange inflows and whale movements will be key to anticipating the next market trend for FIST.